First and foremost, we should not forget that the real estate market is very local. The free movement of goods does not apply. So any comparison to real estate prices in Helsinki or Stockholm is definetely interesting but not really practical. The only thing that matters is the local supply and demand. And as long as the supply is low and stable and the demand is increasing, the prices will increase as well.

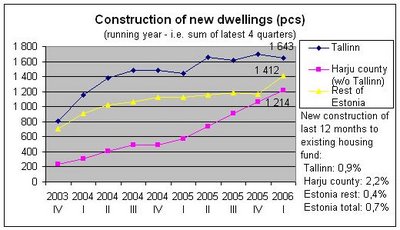

It is generally believed that approximately 1,5% of housing fund should be renewed annually. Logically, on average a house does not stand more than 70 years or so. New construction in other countries has also fluctuated around the 1,5% treshold. In Estonia, new construction still amounts only to 0,7% of existing housing fund (1,2% in Tallinn and its surroundings). The construction intensity has leveled off somewhat and in near term cannot significantly rise due to limitations in planning regulations and lack of workforce in construction as well as in design. So the supply is low and limited.

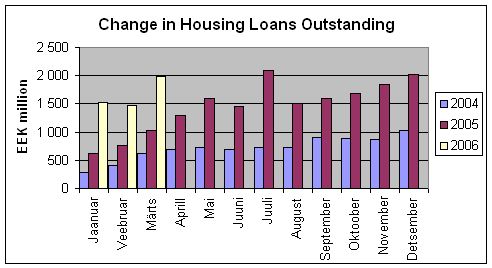

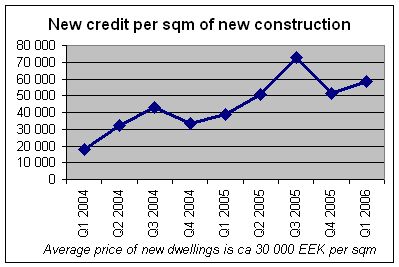

From the demand side, it is true in the long run that if property prices rise quicker than income, demand lowers as less people are able to afford a dwelling. In the short run, however, credit comes to rescue. In 2005 housing loans to GDP ratio in Estonia was 25%, well below EU average of 45%. But the growth is huge - in 2005, housing loans outstanding increased by 17,5 billion EEK, a jump of 75%. As long as such growth continues, there will be more new money flowing to the market that can be accomodated by new construction, i.e. some of the money must be spent on paying higher prices for existing (and new) properties. The statistics from first 3 months of 2006 show no reduction in borrowing, other than the usual temporary dip at the beginning of the year. The borrowing rate is actually two times higher than a year ago.

From the demand side, it is true in the long run that if property prices rise quicker than income, demand lowers as less people are able to afford a dwelling. In the short run, however, credit comes to rescue. In 2005 housing loans to GDP ratio in Estonia was 25%, well below EU average of 45%. But the growth is huge - in 2005, housing loans outstanding increased by 17,5 billion EEK, a jump of 75%. As long as such growth continues, there will be more new money flowing to the market that can be accomodated by new construction, i.e. some of the money must be spent on paying higher prices for existing (and new) properties. The statistics from first 3 months of 2006 show no reduction in borrowing, other than the usual temporary dip at the beginning of the year. The borrowing rate is actually two times higher than a year ago. As people are more and more willing to take on new loans to increase their living standards to Western European levels (and all signs show that they are) we can predict a 20% increase in reale estate prices for the coming year as well. So watch out for those housing loan statistics and look for great returns on residential property in Estonia

As people are more and more willing to take on new loans to increase their living standards to Western European levels (and all signs show that they are) we can predict a 20% increase in reale estate prices for the coming year as well. So watch out for those housing loan statistics and look for great returns on residential property in Estonia

P.S. the author still lives in a rented appartment.

No comments:

Post a Comment